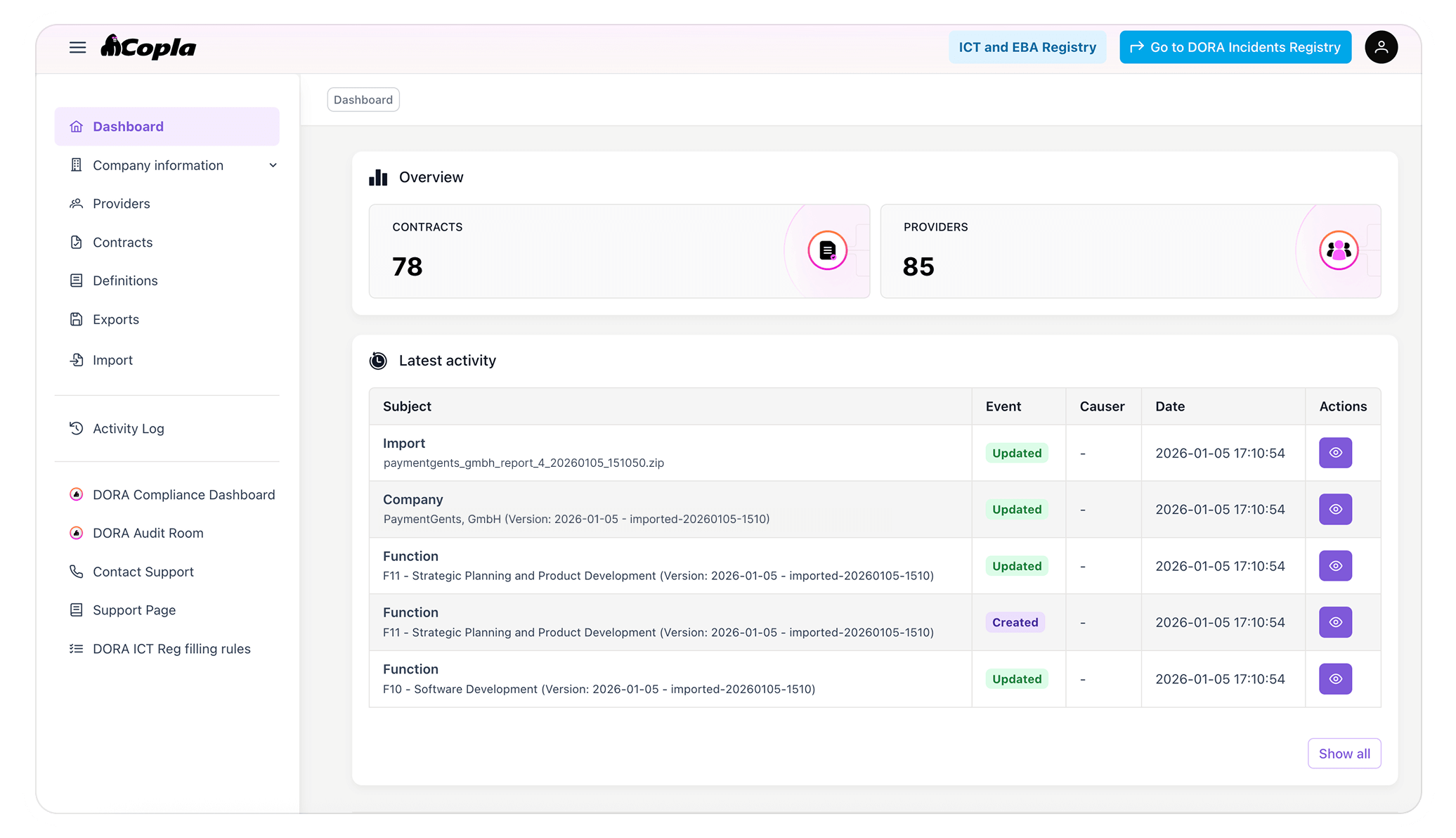

Copla Registry keeps your register structured, validated, and traceable as providers, contracts, and classifications change, so submissions hold up under local supervisory review.

Copla Registry is a dedicated tool for maintaining and reporting ICT third-party data required by financial regulators across the EU. It focuses on structure, consistency, and validation of reporting data in environments where requirements and supervisory expectations evolve over time.

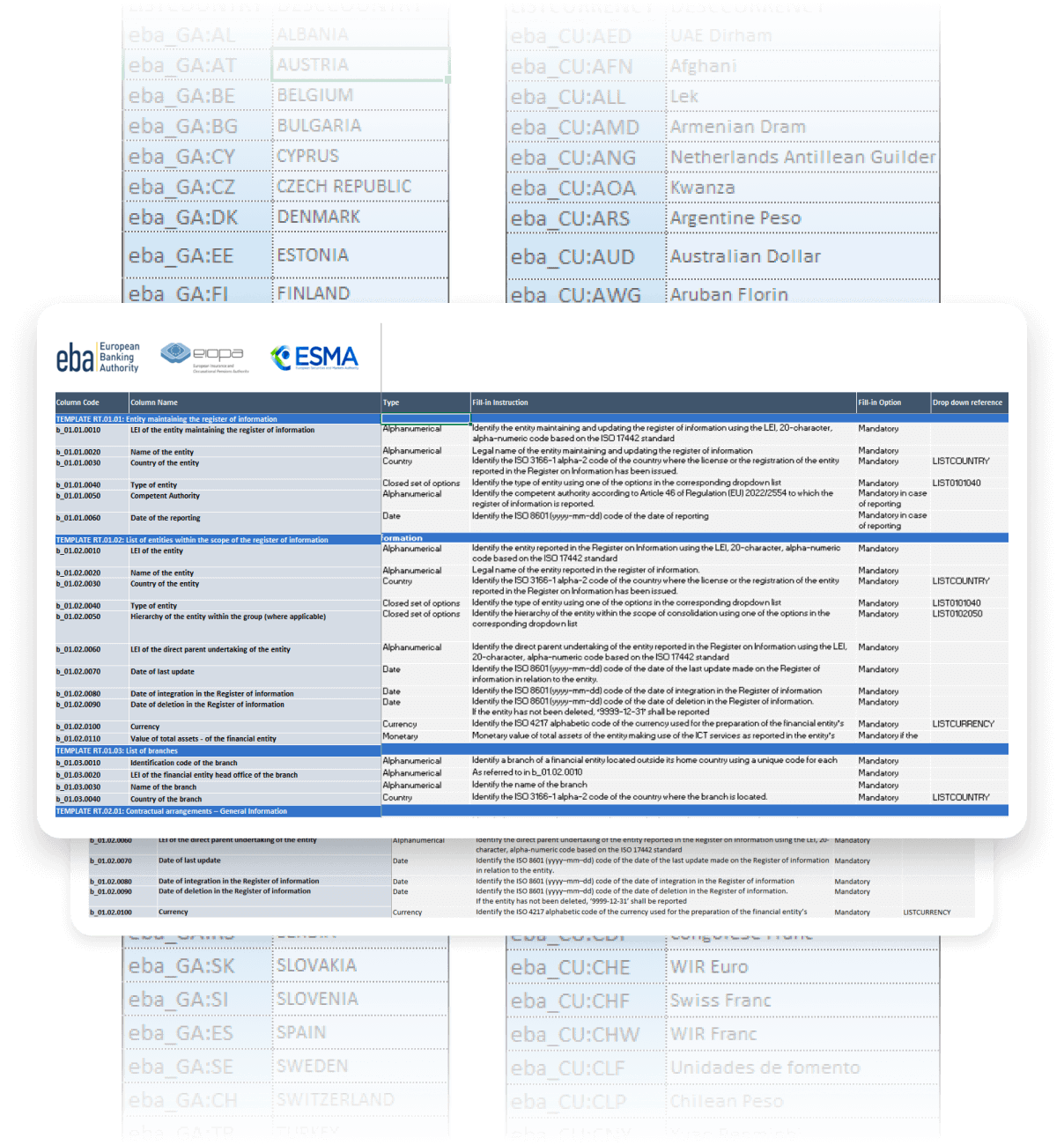

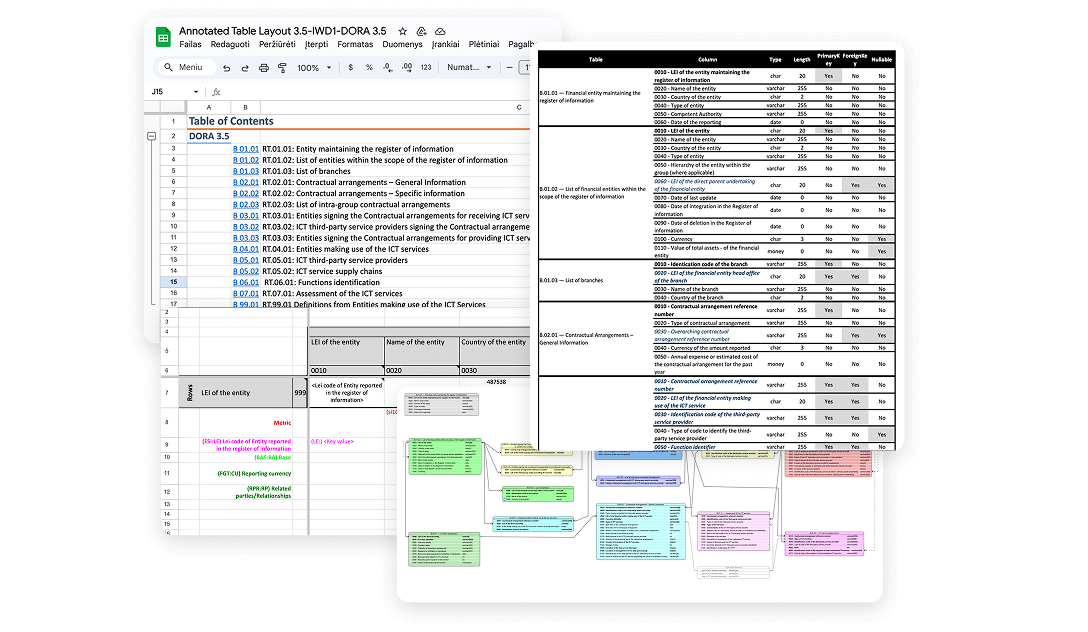

Coded fields and cross-sheet dependencies are hard to align

Issues surface during regulatory submission

Providers, contracts, and classifications evolve throughout the year

Data passes between teams, versions, and owners

Copla Registry provides a controlled reporting environment where regulatory register logic and data consistency are handled by the system. As ICT third-party data changes over time, the system maintains structure, traceability, and readiness for regulatory review without relying on manual interpretation.

The system applies regulatory register rules consistently so reporting data follows the same structure every time.

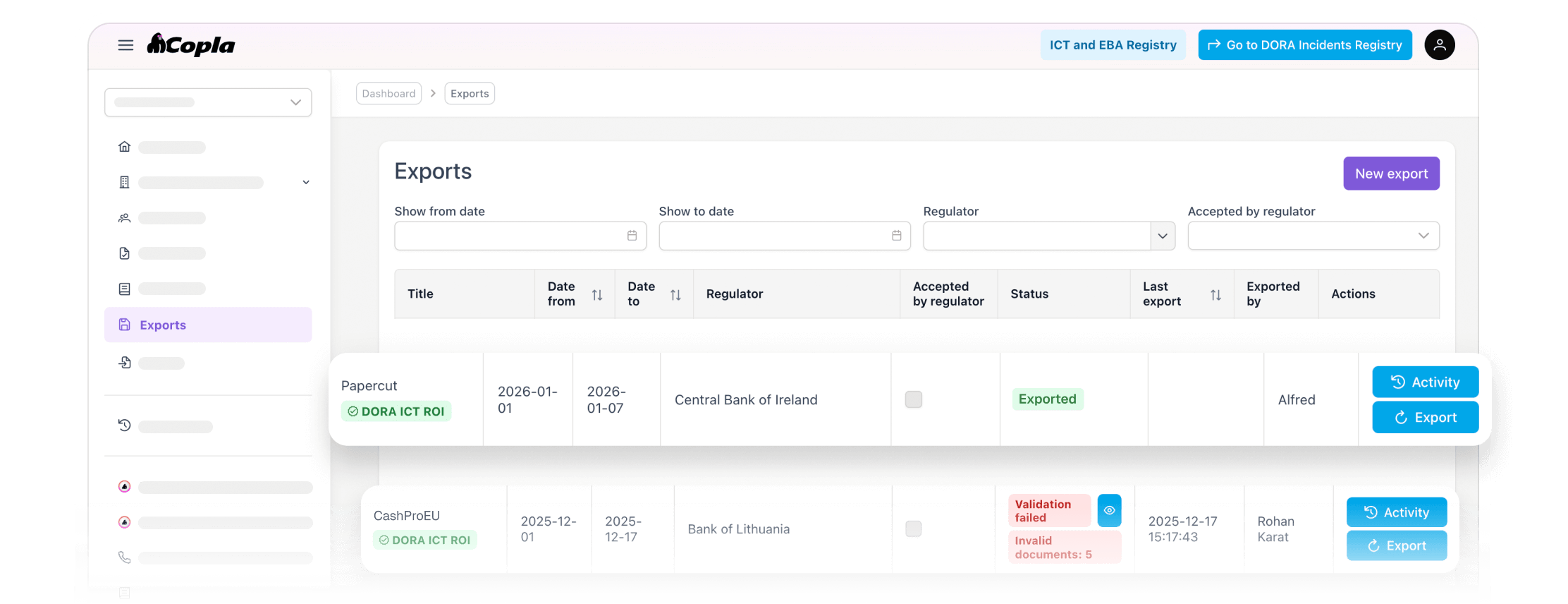

Reporting data is checked for completeness and logical consistency before it is prepared for regulatory submission.

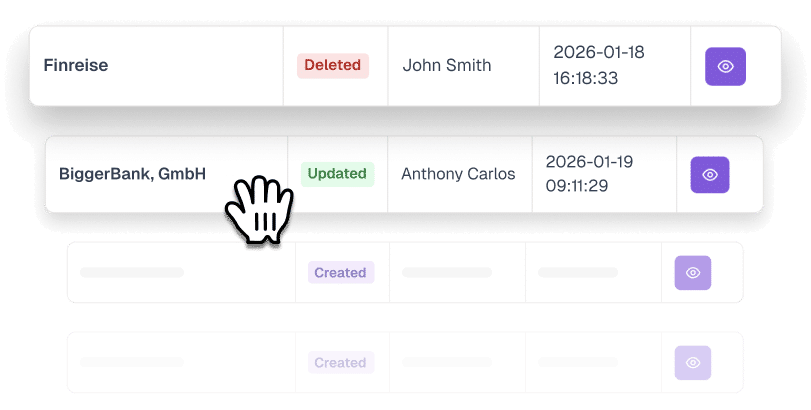

Every update is recorded with clear history, making it easy to review and explain reporting data over time.

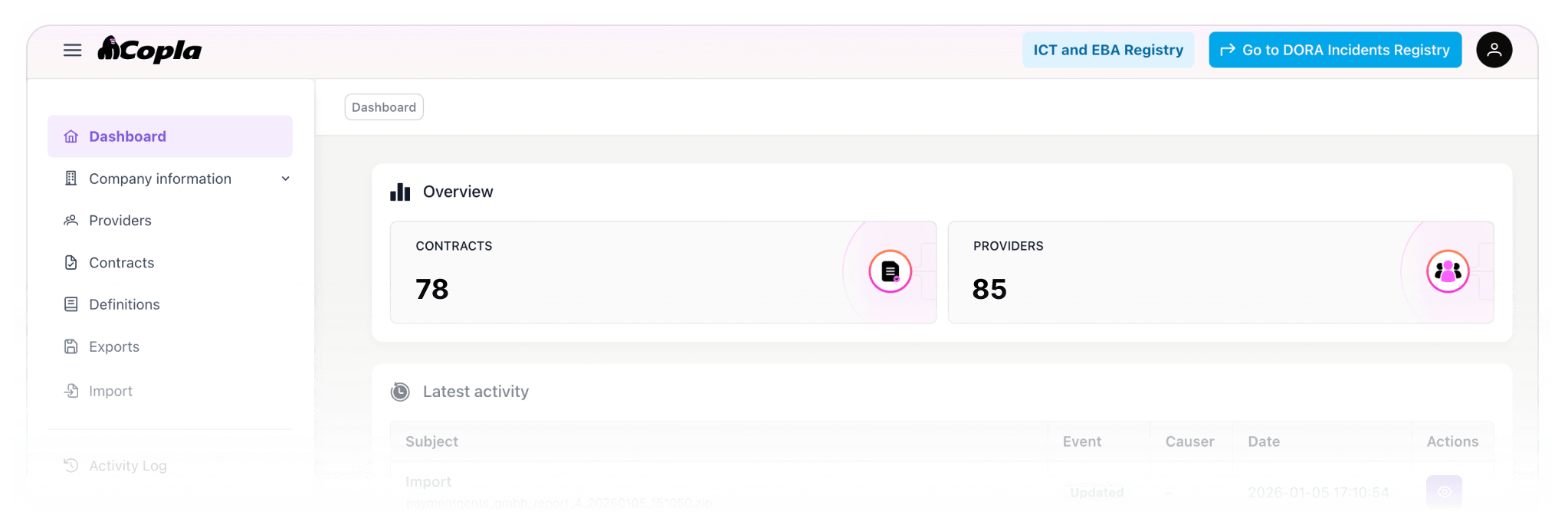

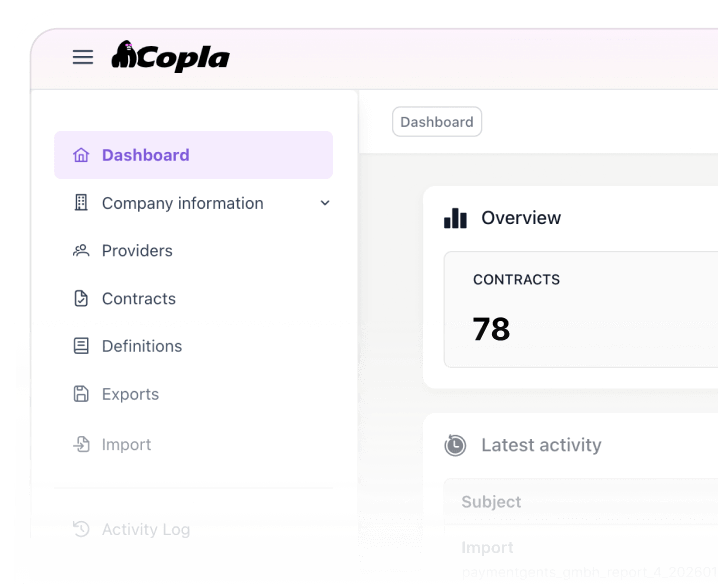

Copla Registry provides a simple and intuitive way to maintain ICT third-party reporting data over time, without relying on complex templates or fragile processes.

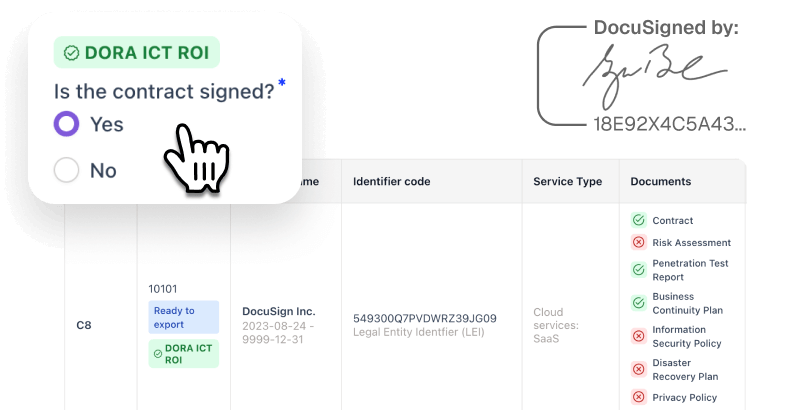

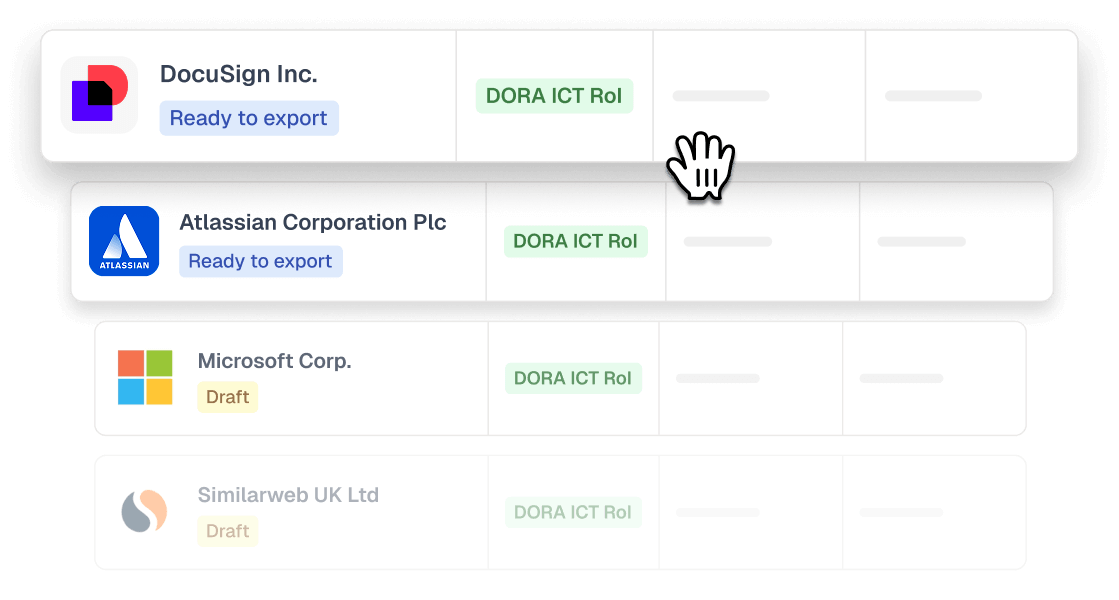

ICT third-party information is captured through structured, form-based inputs that reflect regulatory register logic directly.

As providers and contracts change or are being updated, the system maintains structure, validation, and traceability automatically.

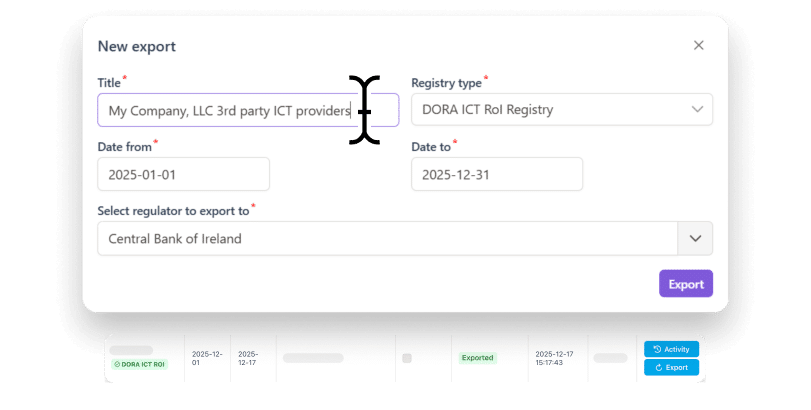

Reporting data remains complete, consistent, and ready for upload whenever regulators request it.

Copla Registry replaces spreadsheet-heavy reporting with a simpler, form-based system that keeps ICT third-party data structured and traceable. The result is less manual coordination and fewer late-stage fixes when reports are reviewed.

Copla Registry exists because regulatory register logic is internally consistent but difficult to execute correctly using spreadsheets and coded templates.

Fields, relationships, and classifications are made explicit so reporting does not depend on individual interpretation, vlookups or memory.

The system reflects EBA register logic while supporting differences in how national regulators expect reporting data to be prepared and reviewed.

Copla reduces the amount of manual reconciliation and review work carried by CISOs, compliance, and risk leads.

Copla does not replace regulatory judgment or supervisory interpretation. It provides a consistent reporting foundation that teams can confidently review, explain, and submit to their local regulators.

Price starts at 500 Eur/year

The DORA Register of Information is a required inventory of ICT third-party service providers that financial institutions must maintain to comply with the EU's Digital Operational Resilience Act (DORA). It ensures transparency and risk management by detailing critical services and contractual relationships.

All financial institutions within the EU, including banks, insurance companies, fintech firms, and payment service providers, must maintain a DORA Register of Information to comply with regulatory requirements and ensure operational resilience.

To use Copla Registry, enter your company information through the guided form, then add your ICT providers. Link contracts to each provider, including dates, scopes, and SLAs. Finally, select the reporting date and export the register in XML or CSV format for compliance.

Copla offers a comprehensive cybersecurity and compliance platform, including a Copla Registry, that automates up to 80% of compliance tasks, including evidence collection and risk assessments. Using its beskope chat engine it provides real-time training, expert CISO guidance, and supports multiple frameworks like DORA, ISO 27001, SOC2, and NIS2.

The DORA Register of Information requires financial institutions to maintain a detailed inventory of all ICT third-party providers, including their contractual details, business functions, risk assessments, and service criticality. Institutions must also track subcontractor chains and ensure the register is updated regularly to comply with the EU's Digital Operational Resilience Act.

The DORA Register of Information reporting process involves maintaining a detailed inventory of ICT third-party providers, including contract details, business functions, service criticality, and risk assessments. Financial institutions must regularly update this register to ensure compliance with the DORA. For ease and accuracy, Copla offers a streamlined tool to automate this process and ensure your reports are fully compliant.

You can find a DORA Register of Information template through various sources, including online tools and resources. However, for a fully automated, customizable, and compliant solution, we recommend using the Copla Registry. It provides a user-friendly interface that allows you to simplify data entry and generate reports that meet regulatory requirements.

Yes, we can provide examples to help you understand how to structure your DORA Register of Information. To see a practical example of how the Copla tool works and how it can simplify the process, we encourage you to get in touch with us. Our team will be happy to provide you with a demo or a sample of our tool in action.

The DORA Register of Information must be maintained and regularly updated. Specific deadlines depend on your institution's reporting cycle and regulatory guidelines. Financial institutions must ensure they meet these deadlines to avoid penalties. To stay ahead of the deadlines, Copla helps you manage updates efficiently and stay compliant with real-time reporting capabilities.

DORA Register of Information guidance can typically be found in official EU regulatory documentation and through compliance advisors. However, for easy-to-follow, actionable advice, Copla offers fractional CISO service, including step-by-step instructions and automated tools, to help ensure compliance with DORA regulations.

To ensure DORA Register of Information compliance, it is crucial to maintain accurate, up-to-date records of all ICT third-party providers, as outlined by DORA guidelines. Copla offers an automated tool that ensures your DORA Register is continuously compliant by validating data, generating reports, and streamlining updates, all while meeting regulatory standards.

While you can find various DORA Register of Information templates in Excel format, for a more efficient and error-free experience, we recommend using Copla's automated Registry. It supports Excel and xBRL-CSV exports while providing an optimized workflow to maintain compliance without the complexity of manual spreadsheets.