If you work in a regulated industry, you’re probably feeling the major shift happening: supervisory expectations are getting sharper, while the pace of change in technology (and threats) keeps accelerating. The need for a strong ICT compliance program has never been greater.

In light of the current regulatory and threat landscape, Copla strives to be a partner, easing compliance burdens. That’s why we’re excited to announce a big milestone: we raised a €6 million Series A.

The investment round was led by Iron Wolf Capital, with participation from Operator Stack and existing investors including Specialist VC, SuperHero Capital, FirstPick, NGL Ventures, and Loggerhead Partners.

100+ Regulated Customers and Seven-Figure ARR

Copla was founded in 2023 and is headquartered in Vilnius, Lithuania. Within just over a year of our previous seed round, we reached seven-figure annual recurring revenue and now serve more than 100 regulated European customers.

That kind of adoption signals something important: the market is actively looking for a more operational model of compliance, especially for ICT and cybersecurity-heavy obligations.

Why This Round Matters

Here’s the thing: regulation isn’t just increasing; it’s becoming more operational. The Digital Operational Resilience Act (DORA) is now mandatory; key obligations under the EU Artificial Intelligence Act (EU AI Act) take effect in August 2026, and the Cyber Resilience Act applies from December 2027. That’s a stacked roadmap, and it hits hardest when your compliance program is still built like a yearly documentation project.

Our bet is straightforward: instead of treating compliance as paperwork, make it a continuous infrastructure, the same way you treat uptime, observability, and incident response.

“Regulation is getting sharper, but most compliance is still stuck in spreadsheets. We built

Copla so compliance stays current by default, and so companies can grow with confidence

instead of audit anxiety. This round gives us the momentum to make Copla the default

compliance execution layer for regulated finance in Europe and beyond,” said Aurimas

Bakas, Co-founder & CEO, Copla.

What Copla Builds: From Checkbox Compliance to Operational Resilience

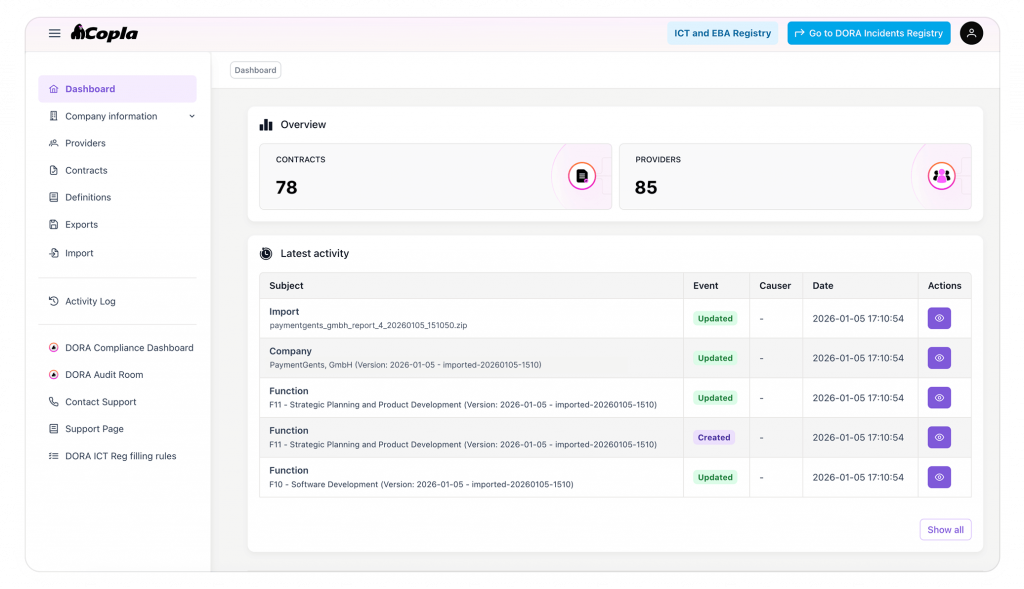

Our platform focuses on Information and Communication Technology (ICT) compliance, translating frameworks like DORA, the EU AI Act, and the Cyber Resilience Act into guided, evidence-based workflows. In practice, that means breaking requirements into concrete tasks, tracking execution continuously, and storing evidence automatically, so teams can stay audit-ready without living inside a mess of spreadsheets and registers.

Real-Time Registers Instead of Static Spreadsheets

If your asset inventory, vendor list, risk register, and control library drift out of date the moment someone ships a new integration, you know the pain. Copla positions itself as a replacement for those static tools by keeping records of assets, vendors, risks, and controls updated “in real time” as the business changes and regulation evolves.

The benefit is simple: less manual chasing, fewer blind spots, and a faster path from “we should” to “we did, and here’s the evidence.”

Platform, Plus Hands-On Expertise When Automation Hits Its Limits

Not everything can (or should) be automated. Copla complements the platform with in-house and fractional CISO support, plus a network of partner providers across Europe, aimed at helping with audits, risk decisions, and regulator interactions.

Working with fintechs and banks like Fjord Bank, a loans & deposits bank, we’ve seen that regulated organizations don’t need more theory—they need execution.

Where the Money Goes: Product Expansion and Scaling Beyond the EU

Copla says the Series A will fund three main priorities: product expansion, team growth, and international scaling beyond the EU.

Copla Bridge: One View Across Multiple Entities and Partners

A standout product direction is Copla Bridge, a new platform layer designed to help partners, consultants, and multi-entity organizations manage compliance across companies from a unified view.

If you’ve ever tried to centralize compliance across subsidiaries, regulated entities, or a group structure, you already know why this is a big deal: “consistent” becomes a full-time job unless the tooling is built for it.

When Compliance Becomes Infrastructure, Everyone Breathes Easier

Copla’s Series A is a signal that regulated finance is buying into a new category: real-time compliance infrastructure. If the next wave of European regulation is pushing you toward continuous resilience, the platforms that operationalize compliance through workflows, evidence, and up-to-date registers will be the ones that win.