If there’s any country that could realistically run on Wi-Fi and strong coffee alone, it’s Estonia. Digital ID, e-Residency, e-tax, e-health – for most of Europe, this is a keynote slide. For Estonia, it is Tuesday.

Now enter the Digital Operational Resilience Act (DORA). On paper, it is just another EU regulation. In practice, it is the moment Brussels looks at Europe’s financial sector and says:

“Nice apps. Now prove they survive a bad day.”

Estonia already lives and breathes digital. DORA doesn’t overturn that. Instead, it standardizes how financial entities – and their ICT partners – manage risk, report incidents, and control third parties across the EU.

In this article, I want to walk you through how DORA actually lands in Estonia: how it matters for financial institutions, what is different (and what is not), how existing Estonian laws already support DORA-style resilience, and how local firms can help you get from “we think we’re compliant” to “we can show it.”

You will not need a law degree to follow this, I promise.

Download our free DORA compliance checklist template

Why DORA Matters In Estonia’s Digital-First Reality

DORA hits a wide range of financial entities across Europe, and Estonia is no exception.

Suppose you are a bank, credit institution, payment or e-money institution, insurer, re-insurer, investment firm, fund manager, or part of market infrastructure. In that case, DORA is now part of your daily vocabulary whether you like it or not. Even if you are “just” a fintech with a license, you are still in the game.

DORA’s core message is simple: digital operational resilience is no longer a nice-to-have security story. It is a regulated capability. You are expected to manage information and communication technology (ICT) risk the same way you manage credit or liquidity risk – with structure, governance, and evidence.

In practice, that means three big shifts for Estonian supervised entities. First, you need clear ICT governance and risk management: defined roles, formal risk assessments, and board-level visibility.

Second, you must classify and report major ICT incidents according to harmonized EU rules instead of improvising templates each time.

Third, you have to treat ICT third-party risk as a regulated outsourcing problem, not just “we trust our vendor, they seem nice.”

On the other side of the table, DORA introduces the idea of critical ICT third-party providers (CTPPs). These are big tech and cloud players that may be supervised directly at the EU level.

But even if your providers are not formally “critical,” you still need to push DORA-aligned obligations into contracts: reporting duties, cooperation in incidents, resilience testing, and meaningful service levels.

Don’t know if you’re DORA-compliant?

We’ve created a free tool to assess your organization’s DORA readiness in just minutes. Get your compliance score and find gaps now, before auditors do.

How Estonia’s Approach Compares To The Rest Of The EU

DORA is a regulation, so it is already law across the EU. Estonia does not “transpose” it; Estonia configures how it is enforced. That means sanctions, supervisory processes, and local guidance need to be tuned to fit into the existing system.

Finantsinspektsioon – the Estonian Financial Supervision Authority – is the main DORA enforcer for supervised entities. It already oversees banks, insurers, investment firms, and others, so DORA simply makes ICT and cyber part of the core supervision conversation, not an afterthought.

In practice, you get a two-level world. At the EU level, DORA defines the minimum bar. At the national level, Finantsinspektsioon can clarify what “good” looks like in Estonia: how to classify incidents, which thresholds trigger external notifications, how ICT governance should be organized, and what they expect to see in outsourcing oversight.

The Estonian Rules That Quietly Prepared You For DORA

Estonia did not wait for DORA to take digital resilience seriously. Several existing laws and guidelines already push you in a DORA-compatible direction. For many organizations, the task now is to line them up instead of starting from scratch.

| Estonian Regulation Or Measure | Focus Area | How It Aligns With DORA |

|---|---|---|

| Finantsinspektsioon Guidelines On IT / Information Security And Outsourcing | ICT governance, IT risk management, outsourcing, continuity | Very close to DORA on roles and responsibilities, risk assessments, vendor due diligence, ongoing monitoring, and reporting of disruptions. |

| Estonian Cybersecurity Act (NIS / Moving Toward NIS2) | Cybersecurity and incident notification for “vital services” and some digital providers | Supports DORA’s push for monitoring, serious incident notification, and baseline security, especially where infrastructures interact with the financial system. |

| Estonian Personal Data Protection Act (Supplementing GDPR) | Personal data protection, security of processing, breach notification | Overlaps with DORA when ICT incidents involve personal data, helping align access control, security controls, and breach reporting flows. |

Because of this, many Estonian financial entities already run IT risk and cybersecurity frameworks, rely on strong digital identity, and plug into secure e-government rails. The gap is usually not “we have nothing,” but “we need to tighten and standardize.”

The most work tends to show up in three places. First, incident classification and reporting need to be properly structured and aligned with DORA and national rules.

Second, digital operational resilience testing needs to move from ad-hoc to planned and repeated, with more advanced testing for some entities.

Third, ICT third-party risk must be mapped and managed in a way that works at both the entity and group levels.

PRO TIP

Monitor Finantsinspektsioon’s updates or public consultations for localized DORA interpretations. Staying ahead of local clarifications minimizes the risk of non-compliance due to procedural mismatches.

DORA Registers: Your New Evidence Engine

One piece many teams underestimate at first is DORA’s love of registers. You are expected to keep structured, up-to-date records of things like ICT incidents, digital operational resilience testing, and contractual arrangements with ICT providers.

Think of these DORA registers as your evidence engine: when Finantsinspektsioon or an internal auditor asks “show me,” you do not start digging through emails and SharePoint folders. You open a register and walk them through clean, consistent data.

If you build those registers well – ideally integrated with your existing tools, not as yet another Excel graveyard – reporting, audits, and management decisions all get faster and far less painful.

What DORA Means For Estonia’s Tech And Startup Ecosystem

DORA’s legal text is aimed at financial entities, but tech providers feel it almost immediately, especially in a country like Estonia, where half the economy writes or runs code.

At the top of the pyramid, some large ICT providers may be named as critical ICT third-party providers at the EU level. They get direct oversight from European Supervisory Authorities. Estonian financial entities using them will feel this via stricter conditions, more reporting, and heavier documentation.

For the wider ICT landscape – software shops, cloud and hosting providers, managed service providers, and cyber consultancies – DORA shows up in procurement and contracts.

Financial clients will push for better due diligence, tighter SLAs, explicit incident notification timelines, audit and testing rights, and clearly described roles in continuity and recovery. If you support resilience exercises, you become part of a regulated resilience chain, not just “the vendor.”

A vendor incident can easily become a DORA incident for your client. That means you will be expected to give clear, timely information, cooperate with investigations, and help stabilize and restore services. Slow, vague replies are no longer just annoying – they are regulatory risk.

The upside for Estonian tech is real. Suppose you can show that your governance, security, and contracts already align with DORA expectations.

In that case, you become an attractive partner for banks, payment institutions, insurers, and investment firms who want less friction during audits and supervisory reviews.

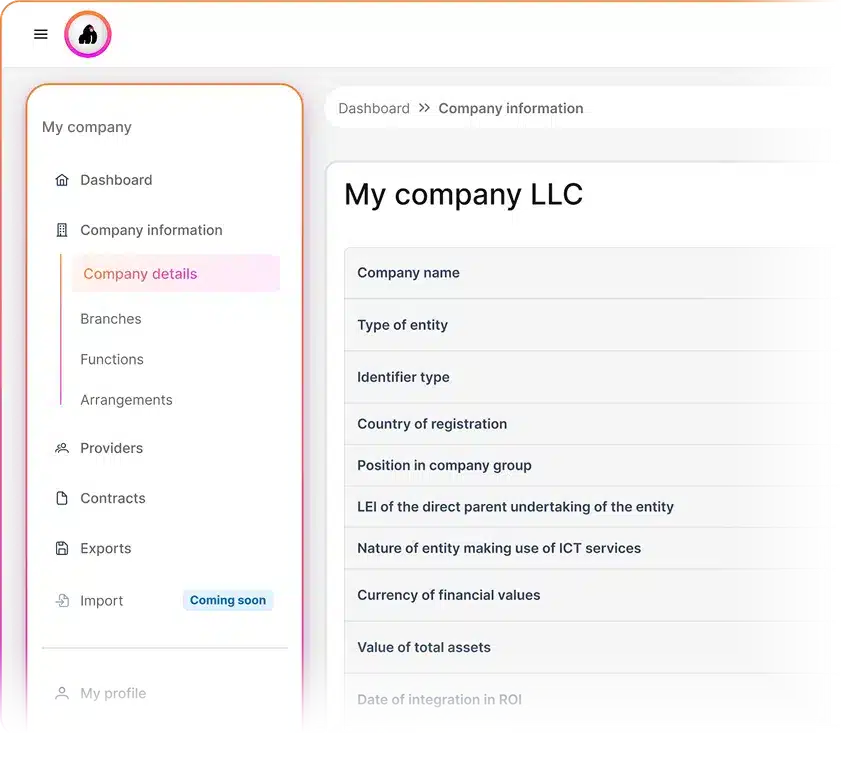

Ensure DORA compliance in Malta with Copla

Copla is built for teams that want DORA compliance without burning out their staff or their budget. By pairing an automation-first platform with expert CISOs, Copla delivers 4 main advantages:

- Helps to reduce compliance workload by up to 80%

- Automates key DORA and NIS2 compliance tasks

- Guides you through the compliance process step-by-step

- Provides CISO-level leadership without the overhead

On top of that, clients typically save over €60K per year compared to hiring in-house staff to handle the same compliance workload, while staying continuously audit-ready.

The only compliance management platform you’ll need

Copla brings together capabilities such as asset and risk registries, evidence mapping, audit verification, regulatory reporting, vulnerability management, awareness training, and incident tracking — all in one place.

FAQ

-

Which organizations in Estonia are subject to DORA requirements? +

In Estonia, DORA applies to EU-in-scope financial entities supervised by Finantsinspektsioon (banks, investment firms, payment and e-money institutions, insurers, fund managers, crypto-asset service providers, etc.) plus ICT third-party providers designated as critical when they support those entities’ critical or important functions.

-

How should small and medium-sized enterprises in Estonia prepare for DORA? +

If you are an SME in scope, start small but structured: map critical ICT assets and services, identify key third-party providers, document incident processes, and run a simple gap analysis against DORA. Then prioritize a few high-impact actions: governance, asset inventory, incident handling, and basic resilience testing.

-

When will Estonian companies need to comply with DORA? +

DORA applies across the EU, including Estonia, from 17 January 2025. From that date, in-scope Estonian entities are expected to meet the regulation’s requirements, with Finantsinspektsioon and EU supervisors assessing how far you have progressed on governance, ICT risk, incident reporting, testing, and third-party risk.

-

How does DORA impact Estonia’s fintech and digital banking industry? +

For Estonian fintechs and digital banks, DORA means more formal ICT governance, stricter oversight of cloud/ICT vendors, standardized incident reporting, and regular resilience testing. The upside: stronger trust with EU clients and regulators, smoother cross-border scaling, and a clearer playbook for proving that your “born-digital” stack is actually resilient, not just fast.