Luxembourg has always punched above its weight in finance. A small country with a big concentration of banks, funds, payment firms, and insurers, all deeply plugged into cross-border markets and handling serious volumes of sensitive data.

That combination of scale and complexity means one thing: if operational resilience fails here, the impact is not “local.”

Enter the Digital Operational Resilience Act (DORA). On paper, it is “just” an EU Regulation on ICT risk and operational resilience.

In practice, it is the moment where Brussels says to the financial sector: show us, in detail, that your digital backbone can take a hit and keep running.

For Luxembourg, DORA is not a hostile takeover of existing rules. It is more like a system upgrade on top of an already strict regulatory stack.

In this article, I will walk you through how DORA lands in Luxembourg, what actually changes in practice, how it interacts with existing CSSF/CAA and national rules, and which types of firms in Luxembourg are already helping institutions get ready for this new reality.

Download our free DORA compliance checklist template

Why DORA Matters So Much In Luxembourg’s Financial Bubble

Let us start with the obvious: Luxembourg is small in territory, huge in financial significance. The country hosts banks, investment funds, payment and e-money institutions, insurers, and specialized financial players that serve clients across the EU and beyond.

Many of them rely on complex ICT environments, outsourced services, and cloud-heavy architectures.

DORA applies directly to a broad range of these financial entities. It is not optional, and it is not a “soft law” guideline. It requires institutions to do some very concrete things around ICT and resilience, including strengthening ICT governance, managing incidents, testing resilience, and controlling third parties in a structured, evidence-based way.

More specifically, regulated entities in Luxembourg need to use DORA to tighten how they:

- Govern and manage ICT risk at board and management level, not just in IT.

- Classify, manage, and report major ICT-related incidents in a harmonized EU format.

- Run digital operational resilience testing as a systematic, repeatable program.

- Manage ICT third-party risk with clear contracts, monitoring, and exit strategies.

For Luxembourg, this matters for two reasons at once.

First, the financial sector is deeply international. Investors, clients, and partners expect resilience standards that do not depend on which regulator happens to be in charge.

Second, demonstrable DORA compliance becomes part of Luxembourg’s brand: a safe, credible, digitally mature jurisdiction for cross-border finance.

There is also a less obvious angle: DORA opens the door to EU-level oversight for certain “critical ICT third-party providers” (CTPPs) designated at the European level, and pushes all other ICT vendors into a world where their financial clients will demand DORA-aligned performance even if those vendors are not directly under DORA’s scope.

Cloud providers, fintechs, software houses, and managed service providers in Luxembourg will feel this in their contracts, due diligence questionnaires, and day-to-day operations.

The bottom line is simple. DORA gives Luxembourg a chance to codify what many institutions are already doing, while forcing the rest to raise their game to match the expectations of a global financial hub.

Don’t know if you’re DORA-compliant?

We’ve created a free tool to assess your organization’s DORA readiness in just minutes. Get your compliance score and find gaps now, before auditors do.

Is Luxembourg’s DORA Approach Actually Different From Other EU Countries?

DORA is an EU Regulation, so the core rules are identical across Luxembourg, Germany, France, and the rest of the Union.

There is no “Luxembourg-specific DORA text” you must follow separately. Still, the way the rules are supervised, explained, and enforced always has a national flavor.

In Luxembourg, the two main players are clear and well-known:

- The Commission de Surveillance du Secteur Financier (CSSF) supervises banks, investment firms, funds, payment and e-money institutions, and most other financial actors.

- The Commissariat aux Assurances (CAA) supervises insurance and reinsurance undertakings.

Both authorities are very comfortable working with EU legislation and converting high-level rules into practical expectations.

They do this using circulars, regulations, FAQs, Q&As, and targeted industry consultations. DORA will be no exception. You can safely expect additional guidance and clarifications even though the Regulation itself is directly applicable.

PRO TIP

Subscribe to CSSF newsletters or alerts—any sector-specific circulars (like those for investment funds or payment firms) can shape your exact DORA obligations and timeline for compliance.

Where Luxembourg might differ slightly from some other member states is in the way these expectations are communicated and aligned. Because the ecosystem and regulator community are relatively compact, you often get:

- Faster, more direct dialogue between authorities and industry.

- Clearer and more coordinated communication, especially where multiple sectors or business models intersect.

What does that look like in practice? It may mean CSSF or CAA guidance that:

- Refines how to classify incident severity for DORA reporting.

- Clarifies timelines and processes for ICT incident notification.

- Explains how DORA interacts with existing ICT, outsourcing, and internal-control circulars.

So yes, DORA is the same regulation everywhere. But if you are operating in Luxembourg, you should expect a distinctive “Luxembourg layer” of expectations, FAQs, and circulars wrapped around it.

That extra layer is not a burden if you understand it early; it is actually a roadmap for staying on the right side of both EU and national expectations.

How Existing Luxembourg Rules Already Point Toward DORA

DORA is not landing on a blank canvas. Luxembourg has been pushing robustness, ICT risk management, and outsourcing controls for years. In many areas, financial entities already live inside a fairly strict framework that looks very DORA-adjacent.

Three central pillars are particularly relevant: CSSF/CAA ICT and outsourcing rules, Luxembourg’s implementation of the NIS and NIS2 frameworks, and national data protection law aligned with the General Data Protection Regulation (GDPR).

If you put them together, they form a strong baseline that maps quite well to DORA.

| Luxembourg Regulation Or Measure | Focus Area | How It Aligns With DORA |

|---|---|---|

| CSSF and CAA circulars on ICT, security risk, outsourcing, and governance | ICT governance, security controls, outsourcing and third-party risk, internal controls | Reflect DORA’s emphasis on structured ICT governance, clear roles and responsibilities, vendor due diligence, ongoing monitoring, and formal incident management and reporting. |

| Luxembourg implementation of the NIS Directive and transition to NIS2 | Cybersecurity obligations and incident reporting for essential services and certain digital service providers | Supports DORA’s focus on continuous monitoring, threat assessment, and mandatory notification of significant cyber incidents, especially where financial market infrastructures are involved. |

| GDPR and Luxembourg data protection law | Data privacy, security of processing, and breach notification duties | Complements DORA wherever ICT incidents affect personal data, and helps align access control, logging, encryption, and breach-notification workflows with DORA requirements. |

Many institutions in Luxembourg already have IT risk frameworks, outsourcing procedures, and cyber policies that respond to CSSF and CAA expectations. They are used to running risk assessments, maintaining business continuity and disaster recovery plans, and reporting significant incidents.

However, DORA still changes the game in some practical ways. You will likely need to:

- Map existing controls explicitly to DORA’s requirements rather than relying on general “good practice.”

- Adopt standardized ICT incident classification and reporting models that match EU templates.

- Formalize and document digital operational resilience testing programs, not just “occasional” tests.

- Update outsourcing and ICT contracts so they clearly reflect DORA’s third-party and subcontractor obligations.

If you already live in a world of detailed CSSF and CAA circulars, the shift to DORA is not a 180-degree turn. It is more like turning your existing resilience setup into a fully documented, regulator-grade system that can be explained and defended line by line.

DORA Registers: Turning Evidence Into A Single Source Of Truth

One of the more practical shifts DORA brings is the expectation of structured registers instead of scattered documentation. Financial entities in Luxembourg will need to maintain clear, up-to-date registers covering ICT-related incidents, major incidents, ICT third-party arrangements, and digital operational resilience tests.

These DORA registers are not just internal housekeeping tools; they are designed so supervisors like the CSSF and CAA can quickly see what has happened, how it was handled, and how lessons learned feed back into your controls.

If your current records live in a mix of emails, Excel sheets, and ad hoc reports, consolidating them into proper DORA registers is one of the fastest ways to make your resilience story auditable.

The Ripple Effect: What DORA Means For ICT Vendors In Luxembourg

Here is the twist a lot of vendors underestimate: DORA’s legal obligations fall on in-scope financial entities, but the Act’s ripple effect absolutely hits their ICT providers as well.

Suppose you are running a cloud platform, SaaS solution, managed service, or specialist security service for Luxembourg financial institutions. In that case, you cannot ignore DORA just because you are not directly regulated under it.

In practice, you should expect three big shifts.

First, contracts will become sharper. Financial clients will push for DORA-aligned clauses covering:

- Incident notification timelines and content.

- Obligations to participate in resilience and recovery testing.

- Audit and access rights, including on-site or remote assessments.

- Data access, data residency, and exit strategy provisions.

Second, due diligence will level up. The days of lightweight security questionnaires are fading. Instead, you may see:

- Detailed technical and organizational security assessments.

- Evidence-based reviews of certifications, testing programs, and incident-handling processes.

- Deep dives into your own subcontractor and cloud dependencies.

Third, operational integration will become more intense. Clients will expect you to:

- Join their incident simulations and business continuity tests.

- Participate in crisis communication planning and runbooks.

- Provide timely, structured information when something breaks in production.

If a serious incident hits your environment, it can trigger mandatory DORA incident reports from your regulated clients. That means your technical and communication response becomes part of their regulatory storyline.

You may not have “DORA entity” on your business card, but if you serve Luxembourg’s financial sector, you will be judged on how well you operate at a DORA-like maturity level.

The takeaway here is straightforward. Treat DORA as your indirect rulebook if you want to remain attractive as a vendor. Even without a regulator knocking on your door, your clients will be using DORA to decide whether to keep you in their critical path.

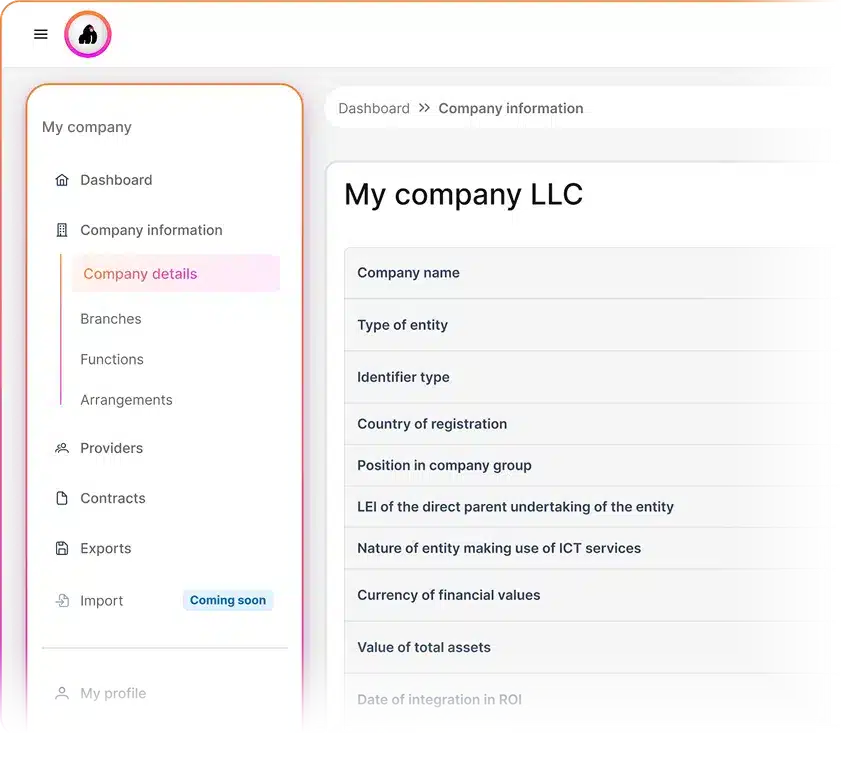

Ensure DORA compliance in Malta with Copla

Copla is built for teams that want DORA compliance without burning out their staff or their budget. By pairing an automation-first platform with expert CISOs, Copla delivers 4 main advantages:

- Helps to reduce compliance workload by up to 80%

- Automates key DORA and NIS2 compliance tasks

- Guides you through the compliance process step-by-step

- Provides CISO-level leadership without the overhead

On top of that, clients typically save over €60K per year compared to hiring in-house staff to handle the same compliance workload, while staying continuously audit-ready.

The only compliance management platform you’ll need

Copla brings together capabilities such as asset and risk registries, evidence mapping, audit verification, regulatory reporting, vulnerability management, awareness training, and incident tracking — all in one place.

FAQ

-

When does DORA come into effect in Luxembourg? +

DORA applies directly in Luxembourg, like all EU Member States, from 17 January 2025. There is no separate “Luxembourg date” – once live at the EU level, in-scope Luxembourg entities must comply.

-

What steps should Luxembourg companies take first to get ready for DORA? +

Start by mapping: critical ICT assets, important/critical services, key third-party providers, and existing incident processes. Then run a gap analysis against DORA, prioritize fixes for governance, incident reporting, testing, and outsourcing, and assign clear ownership at board and C-level.

-

How will DORA affect the daily operations of financial institutions in Luxembourg? +

Expect more structured ICT risk management, tighter incident reporting timelines, regular resilience testing, and closer scrutiny of cloud and other ICT providers. Day to day, this means more documented processes, more evidence gathering, and more cross-team collaboration between IT, risk, compliance, and operations.

-

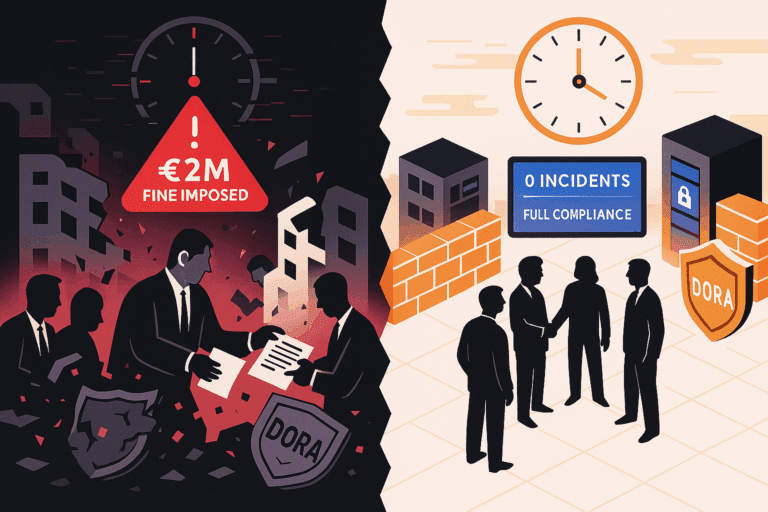

What are the main risks for Luxembourg companies if they ignore DORA? +

Regulatory fines, remediation orders, and restrictions on business are obvious. But the bigger risks are operational: unmanaged ICT failures, cyber incidents, loss of client and regulator trust, and potential impact on your ability to serve EU markets or stay in key value chains.