Let’s be blunt: in today’s financial world, “cyber resilience” can’t be a side quest. Whether you’re running a bank, building fintech infrastructure, or managing a mid-sized investment firm, digital risk is operational risk — full stop.

The EU’s Digital Operational Resilience Act (DORA) doesn’t just agree. It codifies it.

In Malta, where finance and digital services power a sizable chunk of the economy, DORA is arriving at a pivotal moment. The foundations are already there — strong regulators, existing ICT and outsourcing frameworks, a tech-savvy financial sector. But DORA changes the game by demanding uniformity, transparency, and ongoing proof of resilience.

In this piece, I’ll walk you through what DORA means for Malta’s financial ecosystem — what’s already aligned, what’s changing, and how both traditional players and new tech providers should be thinking about compliance. Not in theory. In practice.

Download our free DORA compliance checklist template

Why DORA actually matters in Malta

Malta’s financial services sector — banks, insurers, payment‑and‑e‑money firms, investment services, and more — plays a big role in its economy. Over the past decade, Maltese authorities have tightened up operational risk, ICT (information & communication technology) governance, and cybersecurity rules to stay competitive and credible.

DORA steps in as the EU’s unified playbook for managing ICT risk, reporting incidents, and overseeing third‑party tech providers across the financial sector.

In Malta’s case:

- The Malta Financial Services Authority (MFSA) is the main regulator for most financial entities.

- The Central Bank of Malta oversees payment/settlement systems and financial stability — areas clearly in the resilience mix.

- Because many Maltese financial firms operate cross‑border in the EU, DORA compliance helps simplify governance and signals to international clients/partners that “yes, we meet EU resilience standards.”

In short: Malta isn’t reinventing the wheel — DORA just raises the bar, harmonises expectations, and says “we expect you to prove you’re resilient, not just assume it.”

Is Malta’s approach any different from other EU jurisdictions?

Short version: Not dramatically. Because DORA is a regulation, it applies uniformly across all EU Member States — Malta included.

But, yes — local outlook matters. Here’s how:

Local supervisory outlook

The MFSA has published “minimum expectations” for 2024 to ensure that financial entities are preparing for DORA’s application date (17 January 2025).

Malta issued Legal Notice 166 of 2024, which implements DORA’s requirements into Maltese law.

In practice, this means:

- The MFSA is designated the competent authority in Malta for DORA matters.

- The local regulations largely mirror the EU Regulation — they don’t add major extra layers but provide Malta‑specific implementation clarity.

- Some small differences in practice: e.g., thresholds, timelines, supervisory communications may differ in Malta compared to larger jurisdictions simply because of its size and regulatory structure.

What this means for you: if your organisation is Malta‑based (or operating in Malta) but also operates elsewhere in the EU, you should treat DORA as both a baseline and a distinct local compliance track. Align group‑wide frameworks to DORA, but keep one eye on local supervisory communications.

Existing Maltese regulations that align with DORA’s requirements

Good news: Malta already had many of the building blocks of resilience in place. That means you may not be starting from scratch — you’re upgrading.

Here’s a simplified map:

| Maltese framework | Focus area | Alignment with DORA |

|---|---|---|

| MFSA Rulebooks / Circulars on ICT, Cyber, Outsourcing | ICT governance, risk management, vendor oversight | Echoes DORA’s emphasis on structured ICT risk, board accountability, outsourcing supervision. |

| Central Bank of Malta directives (especially on payments systems) | Business continuity, operational resilience of critical infrastructure | Complement DORA’s focus on resilience of critical functions. |

| Data Protection framework (e.g., GDPR implementing law) | Data privacy, breach notification, access controls | Overlaps partly in incident response, controls, but DORA adds non‑personal‑data incidents and broader resilience requirements. |

The key takeaway: if you’ve been serious about ICT governance, vendor risk, business continuity, and incident management already, you’re ahead. DORA just makes those expectations sharper, more standardised and EU‑wide.

Implications for vendors and the Maltese tech ecosystem

Here’s where it gets interesting: DORA doesn’t just hit banks and insurers — it pushes their tech suppliers into the mix too.

For vendors (software houses, cloud‑hosting providers, MSPs) serving Maltese financial institutions, this means:

- If you’re a critical ICT third‑party provider (CTPP) you may become subject to direct oversight under DORA.

- Even if you are not designated “critical”, your financial institution clients will expect from you: rapid incident notification, evidence of controls, participation in resilience testing, and audit/assessment rights.

- For the local fintech/regtech community in Malta, this is a chance: align your offering with DORA‑style resilience, and you become a stronger partner to EU‑regulated financial entities.

Don’t know if you’re DORA-compliant?

We’ve created a free tool to assess your organization’s DORA readiness in just minutes. Get your compliance score and find gaps now, before auditors do.

What to prioritise if you’re a Maltese entity getting DORA‑ready

Alright, you’re in Malta, you’re in‑scope (or anticipate being in‑scope) for DORA. Here’s where you should focus your efforts:

1. Run a gap analysis now

What you’ve done might cover many parts of DORA — but likely not everything. Map your existing controls (cybersecurity, vendor risk, incident management, business continuity) against DORA’s requirements (ICT risk management, testing, third‑party oversight, incident reporting). Identify the gaps.

2. Formalise ICT risk management and governance

DORA demands a documented ICT risk‑management framework, approved by the board or senior management, with clear roles and responsibilities. Set up or refine your ICT asset inventory, business‑impact analyses for critical functions, and vendor risk programmes.

3. Build your resilience testing programme

This is a significant shift: resilience is not just “we have a plan” — it’s “we test it, we break it, we improve it.” Include vulnerability testing, penetration tests, scenario‑based tests, and vendor‑ecosystem drills.

4. Strengthen vendor/third‑party oversight

You must identify, assess, and monitor ICT third‑party providers. Contracts must include suitable checks. For Maltese firms that outsource heavily or integrate tech via vendors, this is a full‑blown agenda.

5. Prepare incident‑reporting and escalation workflows

Beyond data breaches (GDPR), you now have to cover major ICT‑related incidents, notify within defined time frames, and report to regulators. The MFSA expects “sufficient DORA preparedness” from 2024.

6. Stay plugged into MFSA guidance

The regulator will publish circulars, “Dear CEO” letters, and minimum‑expectation notices — all of which signal how the MFSA interprets DORA locally. Set alerts for these.

PRO TIP

Set up alerts for MFSA Consultation Papers and Circulars — these often include early interpretations or implementation expectations that can help future-proof your compliance program.

DORA Registers: What You Need to Track — and Why It Matters

DORA isn’t just about building resilience — it’s about documenting it. That’s where the DORA registers come in.

All in-scope financial entities are required to maintain structured internal registers covering several key areas: ICT-related incidents, significant changes to critical systems, outsourced ICT services (including critical third-party providers), and results of digital operational resilience testing. These aren’t optional. They’re a core part of demonstrating that your risk management isn’t just theoretical — it’s traceable.

The registers must be up to date, accessible to the competent authority (in Malta’s case, typically the MFSA), and consistent with the firm’s internal governance. In cross-border groups, they should also be harmonised across jurisdictions.

For Maltese firms, this means your incident register can’t just be an Excel file buried in someone’s laptop. You need a robust system for logging, categorising, and updating records in line with DORA’s definitions and thresholds.

If you haven’t already started building these registers — or automating their upkeep — now’s the time. When the regulator asks for evidence, these logs will be one of the first things they want to see.

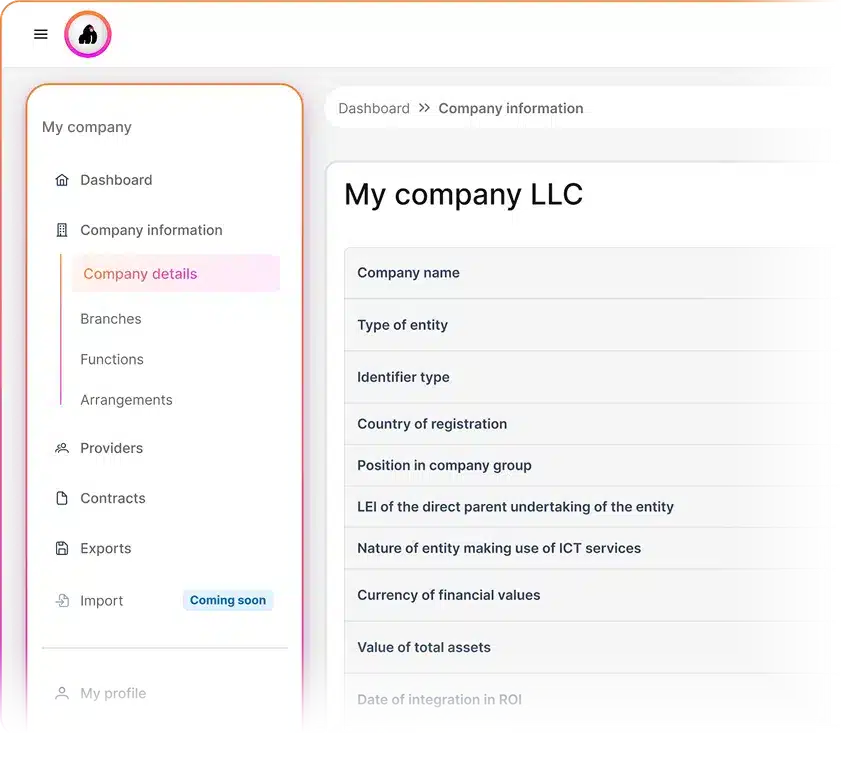

Ensure DORA compliance in Malta with Copla

Copla is built for teams that want DORA compliance without burning out their staff or their budget. By pairing an automation-first platform with expert CISOs, Copla delivers 4 main advantages:

- Helps to reduce compliance workload by up to 80%

- Automates key DORA and NIS2 compliance tasks

- Guides you through the compliance process step-by-step

- Provides CISO-level leadership without the overhead

On top of that, clients typically save over €60K per year compared to hiring in-house staff to handle the same compliance workload, while staying continuously audit-ready.

The only compliance management platform you’ll need

Copla brings together capabilities such as asset and risk registries, evidence mapping, audit verification, regulatory reporting, vulnerability management, awareness training, and incident tracking — all in one place.

FAQ

-

When does DORA come into effect in Malta? +

DORA applies in all EU Member States, including Malta, from 17 January 2025. There is no national “opt-in” date: once live at the EU level, it is directly applicable to Maltese in-scope entities.

-

Which organizations in Malta must comply with DORA? +

DORA covers most regulated financial entities and certain ICT third-party providers. In Malta this includes banks, payment and e-money institutions, investment firms, insurers, fund managers, crypto-asset service providers (MiCA-in-scope), and critical ICT/service providers supporting them.

-

What are the penalties for non-compliance with DORA in Malta? +

Penalties are set by the Central Bank of Malta and may include administrative fines, remediation orders, business restrictions, and, in severe or persistent cases, the withdrawal of authorization for regulated entities or their registrations.

-

Can companies outsource compliance tasks under DORA? +

Yes, you can outsource tasks, but not accountability. Boards and senior management remain fully responsible for DORA compliance, including oversight of ICT and third-party risks. Outsourcing must be governed by robust contracts, due diligence, monitoring, and exit strategies aligned with DORA’s outsourcing and critical ICT provider rules.