Slovakia’s financial landscape, with a growing fintech presence and established banks, reflects the broader EU push for innovation and digitization. As these institutions increasingly embrace cloud services, digital customer channels, and automated processes, regulators are honing their focus on operational resilience. The Digital Operational Resilience Act (DORA) sets forth a harmonized EU framework aimed at strengthening ICT risk management, incident reporting, and oversight of third-party providers.

In this post, I’ll examine how Slovakia plans to adopt DORA, whether the process differs from other EU countries, and how Slovak regulations already align with DORA’s key objectives. We’ll also share a brief list of auditors in Slovakia who can guide businesses through DORA compliance.

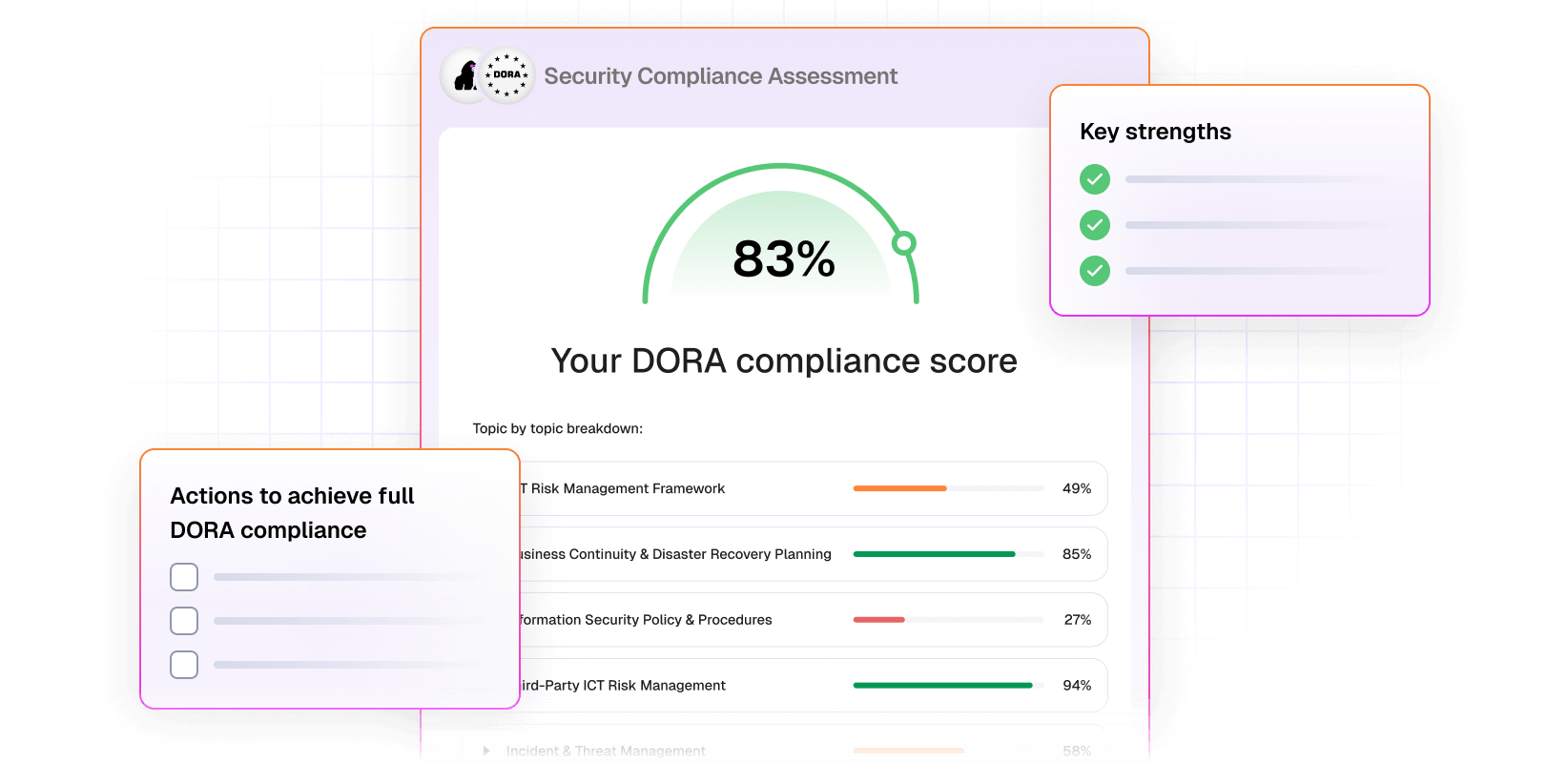

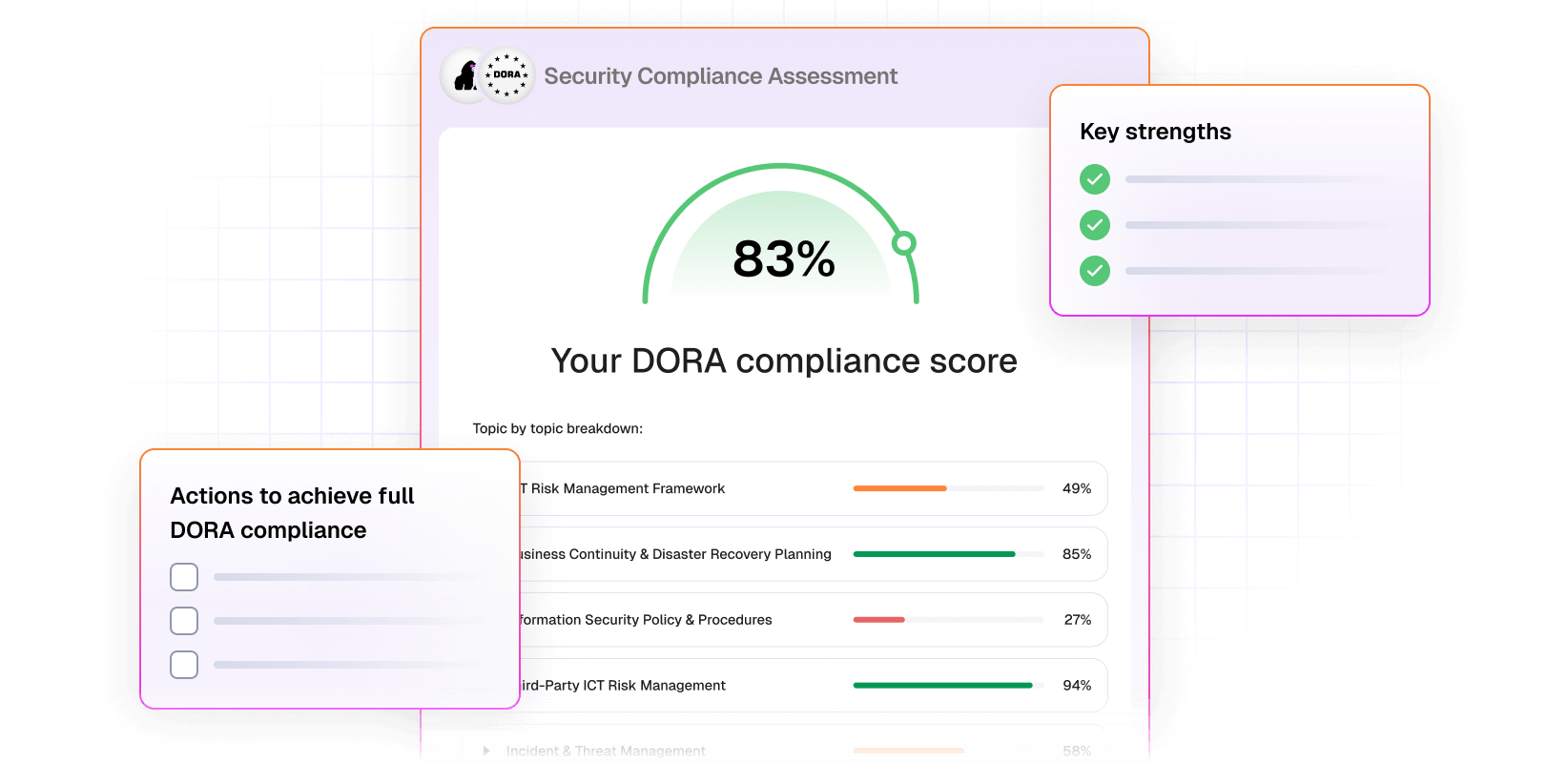

Assess your DORA readiness for free!

Evaluate your organization’s compliance gaps and find areas for improvement—no prior DORA knowledge needed.

Why DORA matters in Slovakia

DORA primarily targets financial entities—banks, investment firms, insurers, and similar institutions—but any company delivering critical ICT services to these sectors also falls under its umbrella. In Slovakia, oversight of financial markets rests with the National Bank of Slovakia (NBS), which has historically required strong risk management practices.

DORA builds on these foundations, introducing standard EU-wide rules for incident handling, vendor due diligence, and cyber risk assessments. Because Slovakia is fully integrated into the EU, local institutions must ensure their internal processes meet or exceed DORA’s expectations, especially those with cross-border activities in other EU jurisdictions.

PRO TIP

If your company operates across borders or serves EU clients, build DORA compliance into vendor contracts and incident response playbooks now. This not only ensures smoother audits but also signals operational maturity to partners.

Is Slovakia’s approach different from other EU member states?

All EU nations must incorporate DORA’s mandates, yet the manner of implementation can vary. In Slovakia, the NBS tends to work closely with financial entities, issuing guidelines and clarifying expectations as needed. Such collaboration often ensures a smoother transition when new EU regulations come into force. Countries with multiple overlapping regulatory agencies may face more complexity in aligning each body’s requirements. However, Slovakia’s relatively centralized structure should allow for a more straightforward integration of DORA.

That said, local nuances can still arise—for example, the NBS might detail specific reporting channels or slightly adapt incident severity thresholds to match the Slovak market context. Institutions operating across multiple EU countries should watch for these subtleties, ensuring consistent compliance in every jurisdiction they serve.

PRO TIP

Monitor announcements and guidance from the NBS closely—especially around how incident severity thresholds and reporting channels may differ slightly from other EU regulators. Staying ahead locally keeps you aligned globally.

Existing Slovak regulations aligning with DORA

Before DORA, Slovakia already had in place a number of laws and guidelines geared toward cyber resilience and operational stability. The table below offers an overview of key measures and how they align with DORA’s mandates:

| Slovak regulation or measure | Focus area | How it aligns with DORA |

| National Bank of Slovakia (NBS) decrees on operational risk and IT security | Outline requirements for banks and other financial institutions regarding risk governance, internal controls, and vendor oversight | Parallel DORA’s framework for ICT risk assessments, incident reporting, and robust third-party management |

| Implementation of the NIS Directive in Slovak legislation | Defines cybersecurity obligations for operators of essential services, including parts of the financial sector | Resonates with DORA’s push for mandatory security measures and incident notification processes |

| Personal Data Protection Act (aligning with the GDPR) | Enforces data privacy and breach notification standards | Complements DORA’s emphasis on safeguarding sensitive data and establishing clear breach reporting protocols |

Many Slovak financial entities already adhere to these regulations, meaning DORA will largely formalize and unify what they’re accustomed to. However, DORA’s cross-border uniformity—particularly around incident reporting timelines—may require additional fine-tuning within existing procedures.

Impact on all industries

Although DORA’s main focus is on financial firms, the regulation’s influence extends to any company that provides critical IT services to them. This means software vendors, cloud providers, consulting firms, and others supporting the financial industry must also demonstrate robust operational resilience. A cyber incident at a non-financial vendor could still trigger DORA’s incident reporting obligations if it disrupts key financial processes. Slovakia’s growing tech sector may see this as an opportunity to embed more rigorous security measures early on, fostering better partnerships with established financial institutions.

PRO TIP

If you’re a non-financial tech firm serving banks or insurers, proactively align with DORA—even if not required by law yet. It positions you as a low-risk, high-trust partner, increasing your chances of securing contracts.

List of DORA auditors in Slovakia

DORA itself does not specify a list of approved auditors, but several firms in Slovakia specialize in cybersecurity, ICT risk management, and regulatory compliance. Below is a concise overview of potential partners:

| Firm | Primary expertise | Additional notes |

| Deloitte Slovakia | Cyber risk, operational resilience, regulatory audits | Global capabilities with local teams familiar with Slovak financial regulations |

| KPMG Slovakia | ICT risk management, compliance reviews, financial sector audits | Known for advising major banks and insurance companies on EU directives |

| PwC Slovakia | Cybersecurity, data privacy, governance, risk & compliance | Offers tailored solutions for both local and multinational financial entities |

| EY Slovakia | IT audits, digital transformation, cross-border regulatory guidance | Experience in aligning projects with EU-level standards |

| BDO Slovakia | Internal controls, process optimization, operational risk | Focuses on mid-market institutions and emerging tech players |

| Soitron | Slovak-based IT consultancy, cybersecurity, managed services | Provides hands-on technical support and incident response capabilities |

When selecting an auditor, organizations should weigh each firm’s familiarity with both NBS requirements and the broader context of EU regulation.

PRO TIP

Choose an auditor who not only knows EU frameworks but also understands how Slovak regulators interpret and enforce them. Look for cross-border experience in banking, insurance, or fintech to maximize value.

Fast-track DORA compliance in Slovakia with Cyberupgrade

As DORA enforcement intensifies, Slovak financial institutions and ICT providers are under pressure to deliver resilience, fast. Cyberupgrade helps you do just that—automating incident response, simplifying third-party risk management, and aligning seamlessly with NBS expectations.

Whether you’re a bank, fintech, or cloud vendor, Cyberupgrade reduces audit friction and eliminates compliance guesswork—so you stay ahead, not just compliant.

Don’t wait for regulators to knock. Book a free DORA readiness session today and turn compliance into your competitive edge.

Forging a robust digital landscape

For Slovakia, DORA arrives at a moment when businesses are scaling up their digital offerings and forging cross-border partnerships. While the Act may introduce new layers of accountability—especially for incident reporting and vendor oversight—it also provides a strategic template for building consumer trust and operational resilience. By dovetailing DORA’s provisions with Slovakia’s pre-existing framework, local institutions can more seamlessly safeguard their operations, reinforce compliance, and continue innovating in an increasingly connected financial ecosystem.

Assess your DORA readiness for free!

Evaluate your organization’s compliance gaps and find areas for improvement—no prior DORA knowledge needed.